Corporate Governance

As a corporate citizen trusted by the international community, the Tokyo Seimitsu Group recognizes that enhancing corporate governance to develop fair and highly transparent management activities is vital.

Following corporate governance basic policy, the Tokyo Seimitsu Group is working to build effective corporate governance structures and systems.

Basic Policy on Corporate Governance

Core Policies

1.

The Board of Directors strives to properly perform its roles and responsibilities to make transparent, fair, timely and committed decisions.

2.

The Group respects the rights of shareholders and ensures the equality of shareholders.

3.

The Group strives to have constructive dialogue with shareholders on investment policy that considers medium to long-term returns for shareholders.

4.

The Group strives to maintain appropriate collaboration with stakeholders (customers, suppliers, employees, creditors, local communities, etc.) other than shareholders.

5.

The Group strives to ensure proper information disclosure and transparency.

Basic Policy on Corporate Governance (in full)

Corporate Governance Structure

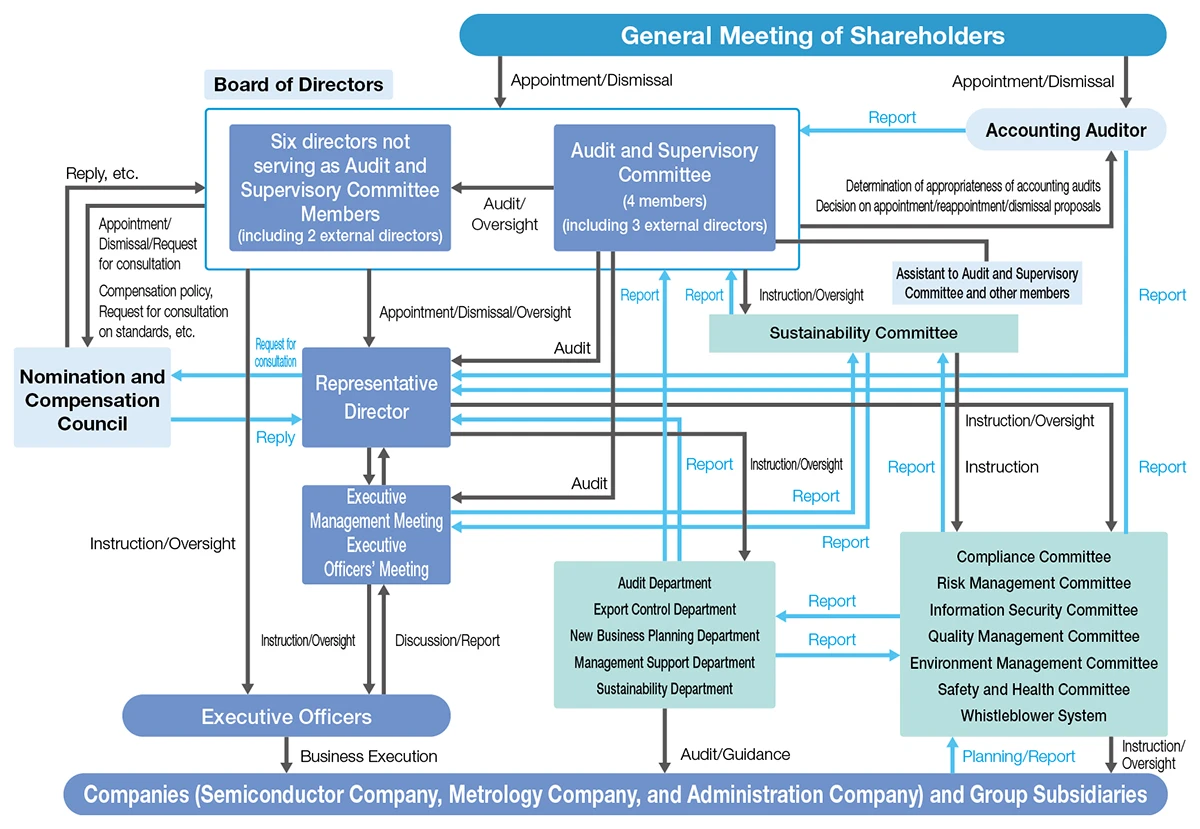

Tokyo Seimitsu has adopted a company structure with an audit and supervisory committee.

For dealing with matters that do not fall under the criteria for submission to the Board of Directors, the Company has adopted an Executive Officer System to speed up the decision-making process by delegating a large amount of authority to the Head of each company after defining their scope of duties and authority in accordance with the relevant regulations of the Company. In addition, the Executive Management Meeting strives to share information and enhance deliberations across company divisions. In addition, various cross-company committees such as the Risk Management Committee and the Compliance Committee have been established to examine and monitor material issues from various perspectives to make appropriate decisions.

Corporate Governance Structure

Board of Directors

Currently, our Board of Directors is composed of six directors not served as Audit and Supervisory Committee members (two of whom are external directors) and four directors served as Audit and Supervisory Committee members (three of whom are external directors). The board is chaired by the chairman. The Board of Directors convened 16 times in fiscal 2024.

The Board of Directors deliberates on important matters related to management as stipulated by law, the Articles of Incorporation, and the Board of Directors Regulations, as well as monthly, periodic, and annual business results, and supervises the execution of business by each director.

Main Agenda Items in FY2024

Business Portfolio Management

Business planning (development, equipment, personnel, expenses, etc.)

Sustainability

Reported on the results of activities of the Sustainability Committee in FY2023

Sustainability Committee report

Company-Wide Risk Management

Report on the results of the activities of the “Compliance Committee” and “Risk Management Committee” conducted in the second half of fiscal 2023 and report on the activities of the Compliance Committee and Risk Management Committee planned for fiscal 2024

Report on the results of the activities of the “Compliance Committee” and “Risk Management Committee” conducted in the first half of fiscal 2024

Other items

Disclosure of the Corporate Governance Report

Assessment of the effectiveness of the board of directors

Partial revision of the “Director Compensation Regulation,” “Basic Policy on Corporate Governance,” and “Nomination and Compensation Council Regulation” and establishment of the “Regulation for Stock-Based Compensation for Directors”

Attendance of Board of Directors Meetings by External Directors

Kiyoshi Takamasu

Attended 16/16 meetings

Kazuya Mori

Attended 16/16 meetings

Yuriko Sagara

Attended 15/16 meetings

Masaki Sunaga

Attended 16/16 meetings

Tsuneko Murata

Attended 4/4 meetings*1

Motoko Kawasaki

Attended 12/12 meetings*2

*1 Retired on June 21, 2024

*2 12 meetings held after Ms. Kawasaki’s appointment

Audit and Supervisory Committee

Our Audit and Supervisory Committee, which is a parallel organization to the Board of Directors, is composed of one internal Audit and Supervisory Committee member and three external Audit and Supervisory Committee members. One of the Audit and Supervisory Committee members has remarkable knowledge of finance and accounting. They audit the Company’s business execution, account processing, asset management, etc. throughout the year by attending the Board of Directors and other important meetings, hearing about the status of business execution, and reviewing important approval documents in order to check for legal violations, breaches of fiduciary duty, and other kinds of misconduct. Also, the Audit and Supervisory Committee exchanges opinions with the Audit Dept., which is an internal audit organization, and the accounting auditor on the audit system to determine whether there are problems in auditing, as well as issues and other matters on an as-needed basis, in an effort to enhance the effectiveness of audits. At the same time, the committee receives regular reports on findings and related information from internal audits conducted in accordance with the annual audit plan.

Committee Chairman

Internal Director

Members

Four (three external directors in addition to the Committee Chairman)

Frequency of meetings

Once every two months (convened 13 times in FY2024)

Attendance of Board of Directors Meetings by External Directors

Yuriko Sagara

Attended 12/13 meetings

Masaki Sunaga

Attended 13/13 meetings

Tsuneko Murata

Attended 4/4 meetings*1

Motoko Kawasaki

Attended 9/9 meetings*2

*1 Retired on June 21, 2024

*2 9 meetings held after Ms. Kawasaki’s appointment

Nomination and Compensation Council

The Company has established a Nomination and Compensation Council as a voluntary committee for the purpose of clarifying the independence, objectivity, and accountability of the Board of Directors functions, especially in nomination and compensation to directors. Independent external corporate directors are in the majority (now five members are independents external corporate directors) on the council, helping to realize deliberations fully independent from management.

Committee Chairman

External Director

Members

Directors who are Audit and Supervisory Committee Members and external directors

Frequency of meetings

Held 5 meetings

Functions

Deliberates and reports to the Board of Directors on matters related to nomination of directors, including appointments and dismissals

Deliberates on and determines the standard of compensation amount per post for director compensation

Deliberates and reports to the Board of Directors on matters related to director compensation policies, etc.

Executive Management Meeting and Executive Officers’ Committee

The Company has in place an executive officer system to make speedy decisions on product development planning to respond quickly and flexibly to market trends. In addition to supervising the progress of business plans at regular monthly meetings of the Executive Management Meeting and Executive Officers’ Meeting, the Executive Officers’ Meeting aims to share information across the Company and enhance Executive Officers’ Meeting deliberations.

Various Committees

Compliance Committee

Chairman

Head of Administration Company

Frequency of meetings

Six times a year (7 times in fiscal 2024, including extraordinary meetings)

Functions

Revises the “ACCRETECH Group Code of Conduct” and other rules and regulations

Deliberates on compliance-related education/training plans and the status of related initiatives

Establishes relevant sections and related organizations that deal with major laws, regulations, and social norms related to business operations, and ensures thorough compliance with laws and regulations

In the event of compliance-related misconduct, the Compliance Committee reports the details of the misconduct and the measures taken to the Board of Directors and the Audit and Supervisory Committee

Risk Management Committee

Chairman

President and CEO

Frequency of meetings

Six times a year plus extraordinary meetings as necessary (6 times in fiscal 2024)

Functions

Receives reports on the prevention of the occurrence of potential risks from sections related to risk, etc.

Reports to the Board of Directors on the agenda of regular committee meetings as necessary

Reports the details of the risk and countermeasures to the Board of Directors the Audit and Supervisory Committee when a report on the materialization of a risk is received and immediately establishes a “Risk Response Team” as necessary

Information Security Committee

Chairman

Head of Administration Company

Frequency of meetings

Twice a year

Functions

Establishes information security management systems

Establishes information security regulations

Promotes and maintains a system for implementing information security measures, related education and training, regular evaluation, and continuous improvement

Quality Management Committee

Chairman

Head of Administration Company

Frequency of meetings

Twice a year

Functions

Deliberates on the adequacy and effectiveness of the quality management system

Continuously improves the performance and effectiveness of the quality management system

Promotes the continuous maintenance and improvement of the quality of our products, services, and operations

Environment Management Committee

Chairman

Head of Administration Company

Frequency of meetings

Twice a year

Functions

Deliberates on and promotes environmental management activities performed at the Hachioji Plant, Hanno Plant, Tsuchiura Plant, and Furudono Plant

Checks status of compliance with environmental laws and regulations and the progress of environmental impact reduction activities

Creates and implements Environmental Management System and continuously improves it

Safety and Health Committee

Chairman

General safety and health managers

(Plant manager of Hachioji Plant, Plant manager of Hanno Plant, and Plant manager of Tsuchiura Plant)

Frequency of meetings

Once a month

Functions

Maintains and improves safe and comfortable work environments

Establishes a system for ensuring safety and managing the health of our employees by appointing legal managers and specialized committees to raise awareness of safety and health in the workplace and to maintain and promote health

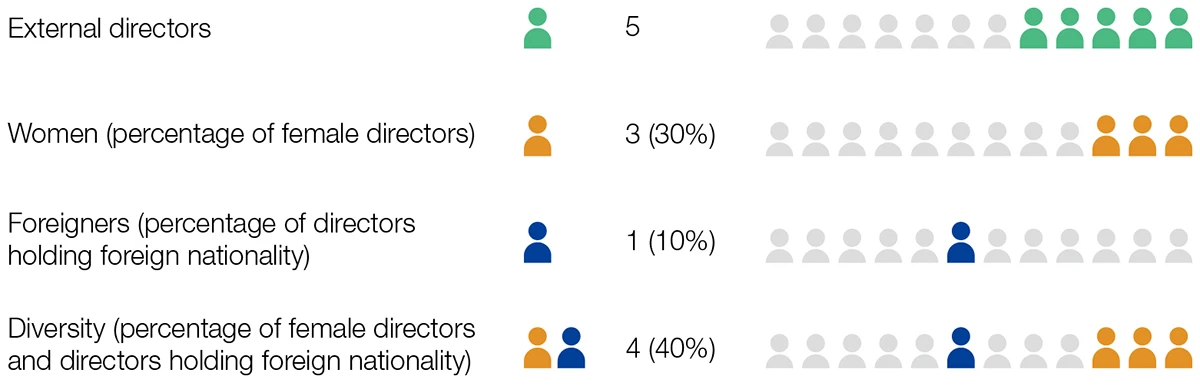

Diversity of the Board of Directors

Reasons for Appointment of External Directors

June 2024

|

Name |

Audit and Supervisory Committee Member |

Independent Director |

Supplementary information |

Reasons for appointment |

|

Yuriko Sagara |

○ |

○ |

- |

Ms. Sagara has never had any certain interest in the Company, i.e., has no current or past experience of providing legal, tax, or other consultancy services for the Company, nor does she have any close relative who has a relationship with the Company. Therefore, the Company keeps her designated as an independent director based on the judgment that there is no risk of a conflict of interest with general shareholders. |

|

Kiyoshi Takamasu |

|

○ |

- |

Mr. Takamasu has never had any certain interest in the Company, i.e., has no current or past experience of executing business with a major business partner or shareholder of the Company, or the same corporation, nor does he have any close relative who has a relationship with the Company. Therefore, the Company keeps him designated as an independent director based on the judgment that there is no risk of a conflict of interest with general shareholders. |

|

Kazuya Mori |

|

○ |

Although the Company has transactions with Japan Semiconductor Corporation, where Mr. Mori was an executive officer in the past, those transactions account for less than 2% of consolidated net sales. Mr. Mori retired from Japan Semiconductor Corporation four years ago and is no longer an executive of that company. |

Mr. Mori has never had any certain interest in the Company, i.e., currently has no experience of executing business with a major business partner or shareholder of the Company, or the same corporation, nor does he have any close relative who has a relationship with the Company. He meets the Company’s independence criteria and remains designated as an independent director because it is considered that there is no risk of a conflict of interest with general shareholders. |

|

Motoko Kawasaki |

○ |

○ |

Although the Company has transactions with FUJIFILM Holdings Corporation and FUJIFILM Corporation, where Ms. Kawasaki was an executive officer in the past, those transactions account for less than 2% of consolidated net sales. Ms. Kawasaki retired from FUJIFILM Holdings Corporation and FUJIFILM Corporation four years ago and is no longer an executive of those companies. |

Ms. Kawasaki has never had any certain interest in the Company, i.e., currently has no experience of executing business with a major business partner or shareholder of the Company, or the same corporation, nor does he have any close relative who has a relationship with the Company. He meets the Company’s independence criteria and remains designated as an independent director because it is considered that there is no risk of a conflict of interest with general shareholders. |

|

Sumiko Takayama |

○ |

○ |

- |

Ms. Takayama has never had any certain interest in the Company, i.e., has no current or past experience of providing legal, tax, or other consultancy services for the Company, nor does she have any close relative who has a relationship with the Company. She meets the Company’s independence criteria and is designated as an independent director because it is considered that there is no risk of a conflict of interest with general shareholders. |

Selection Criteria for Directors and Audit & Supervisory Board Members

In selecting Directors of the Company, regardless of individual attributes such as gender and nationality, persons with superior dignity, ethics, and insight are selected, and are well versed in corporate management and the Company’s business, or persons with extensive experience in their respective fields of expertise. External Director candidates are those who are capable of fulfilling the function of supervising management from an independent standpoint outside the Company and providing advice on the Company’s corporate activities based on their abundant experience and deep insight.

Constitution of the Board of Directors (Skills/Matrix)

| Name | Age |

External director |

Major past experience | Board of Directors | Audit and Supervisory Committee | Nomination and Compensation Council |

Skills and experiences | ||||||||

| Corporate management/ Management strategy |

Industry knowledge | Technology/intellectual property/Manufacturing |

Sales/Marketing | International Business/ Grobal Experience |

Accounting/Finance | Legal/ Risk Management |

Personnel/Labor/Human resource development |

IT/ Information systems |

|||||||

| Hitoshi Yoshida | 65 | Measurement technology |

○ | ○ | ○ | ○ | ○ | ○ | ○ | ||||||

| Ryuichi Kimura | 62 | Semiconductor sales | ○ | ○ | ○ | ○ | ○ | ||||||||

| Takahiro Hokida | 63 | Semiconductor technology | ○ | ○ | ○ | ○ | ○ | ○ | |||||||

| Romi Pradhan | 56 | ● | Overseas subsidiary management |

○ | ○ | ○ | ○ | ○ | |||||||

| Kiyoshi Takamasu | 70 | ◎ | Academic | ○ | ○ | ○ | ○ | ○ | |||||||

| Kazuya Mori | 65 | ◎ | Corporate management | ○ | ○ | ○ | ○ | ○ | ○ | ||||||

| Shinji Akimoto | 61 | Human resources | ○ | ○ | ○ | ○ | |||||||||

| Yuriko Sagara | 50 | ◎○ | Attorney | ○ | ○ | ○ | ○ | ○ | ○ | ||||||

| Motoko Kawasaki | 64 | ◎○ | Corporate management | ○ | ○ | ○ | ○ | ○ | |||||||

| Kiyoko Takayama | 50 | ◎○ | Certified public accountant | ○ | ○ | ○ | ○ | ○ | |||||||

Ages current as of the end of June 2025/Independent External Corporate Director: ◎ Female: 〇 Foreigner: ●

Note: This matrix represents the areas in which we expect each Director to have more expertise and play a more active role, based on their experience and other factors. This matrix does not represent all the knowledge and experience of each person.

Assessing the Effectiveness of the Board of Directors

To improve the performance of the Board of Directors, we assess its effectiveness and discuss future actions every year.

1. Method of Evaluation

The Company conducts questionnaire surveys of all directors (including Audit and Supervisory Committee members) on the items listed below. After the summarized survey results and analysis results were reviewed by the internal and external directors, the Board of Directors held discussions to evaluate its effectiveness and consider future actions.

For preparing the questionnaire as well as compiling and analyzing the results of the questionnaire, we utilize external organizations to ensure transparency and effectiveness.

FY2024 Questionnaire Items

7 items, 25 questions in total

Roles and functions of the Board of Directors

Constitution and scale of the Board of Directors

Management of the Board of Directors

Implementation of internal controls, etc.

Use of external directors

Relationship with shareholders and investors

Progress in the Governance Structure relative to the previous year

The questionnaire not only evaluates each item but also includes open-ended questions about the strengths of the Board of Directors and areas for improvement, and it seeks individual directors' reflections on their contributions to the board, along with any other comments and suggestions they might have.

2. Results of Analysis and Evaluation of the Effectiveness of the Board of Directors

In the Board of Directors, its members with diverse experience and expertise have free and vigorous discussions, with external directors actively offering advice on management based on the knowledge in their areas of expertise. The results concluded that the effectiveness of the Board of Directors was largely ensured, with the provision of ample opportunities for external directors to gain a better understanding of Tokyo Seimitsu.

As part of our efforts to further enhance the discussions about medium- and long-term challenges, which was identified as an issue last year, we took part in group management council meetings and long-term strategy planning meetings by the external directors. As for succession planning, we offer training to candidates and hold discussions at the Nomination and Compensation Council. We also consider it necessary to further deepen discussions.

In addition, we move forward with efforts to grasp the actual situation of executive training to find out more about concrete activities such as external directors’ visits to domestic and overseas plants and sales offices.

At the same time, some issues have been identified from this year’s questionnaire as follows.

Need for further enhancement of discussions about medium- and long-term challenges

Need to deepen discussions on succession planning

3. Future Actions

To further enhance discussions about medium- and long-term challenges, we have set up a medium- and long-term strategy planning team and are building a framework for sharing the contents of discussions with the Board of Directors. We intend to consider the need to review the management of the Board of Directors as well. With regard to succession planning, we will further deepen discussions at the Nomination and Compensation Council in order to ensure that external directors can recognize candidates.

We continue to keep our Board of Directors effective through these activities.

Director Compensation

The Company has established policies and procedures for determining the amount of remuneration, etc. for directors in its “Basic Policy on Corporate Governance.” For details about the policy, compensation structure, etc., please refer to the Basic Policy on Corporate Governance.

Basic Policy on Corporate Governance (in full)

Process for Determining Compensation

ⅰ

The Board of Directors delegates the task of determining the compensation structure and compensation standards for each position to the Compensation Planning Committee, consisting of the representative directors and some other directors.

ⅱ

To ensure transparency and objectivity, the proposal of Directors’ compensation amounts and related matters (such as compensation amount per post), and the amount for each directors’ base compensation, performance-based compensation and stock compensation shall be deliberated on by the Nomination and Compensation Council, consisting of directors serving as an Audit and Supervisory Committee members and external corporate directors.

ⅲ

Compensation amounts for directors serving as an Audit and Supervisory Committee members will be mutually discussed and resolved among directors served as an Audit and Supervisory Committee members.

Among the remuneration paid to directors responsible for business execution, the formula for restricted stock, which is a medium- to long-term incentive to share profits with shareholders, was revised to incorporate capital efficiency (ROE) in 2023 and revised to incorporate ESG score* in 2024.

* ESG score

Evaluation of initiatives for ESG activities including climate actions (0.9 to 1.1 by the Nomination and Compensation Council)

As an assessment score for director compensation, we have incorporated commitment to ESG activities including climate actions. This promotes climate actions and other ESG activities as business strategy, helping us engage in endeavors that contribute more to the resolution of environmental issues.

Total Amount of Compensation by Officer Category, Total Amount of Compensation by Type, and Number of Officers in Each Category

| Total amount of compensation |

Total amount of compensation by type | Number of officers in this category |

||||||

| Base compensation |

Performance-based compensation |

Restricted stock compensation |

Board Benefit Trust (BBT) |

Non-monetary compensation (among forms of compensation listed to the left) | ||||

| Unit | million yen | million yen | million yen | million yen | million yen | million yen | persons | |

| Officer category | Director (excluding Audit and Supervisory Committee members and external directors) |

686 | 227 | 261 | 16 | 182 | 198 | 6 |

| Director (Audit and Supervisory Committee member)(excluding external directors) | 22 | 22 | - | - | - | - | 1 | |

| External director | 42 | 42 | - | - | - | - | 6 | |

Notes 1.

The number of external directors includes one director who retired at the conclusion of the 101st Regular Shareholders’ Meeting held on June 21, 2024.

2.

Compensation to directors (excluding directors served as Audit and Supervisory Committee members) shall be less than 700 million yen per year (within 70 million yen for external directors) as ratified at the 101st Regular Shareholders’ Meeting held on June 21, 2024. Separately, it has been decided to introduce a performance-based stock compensation system known as “Board Benefit Trust” (excluding directors served as Audit and Supervisory Committee members and external directors). Non-monetary compensation shall be the amount of “Board Benefit Trust,” whose expenses are recorded over multiple years, combined with the amount of restricted stock compensation recorded in the current business year, according to the compensation period. The number of directors (excluding directors served as Audit and Supervisory Committee members) at the conclusion of the aforementioned Regular Shareholders’ Meeting is eight, including two external directors.

3.

The maximum amount of remuneration for directors who are members of the Audit and Supervisory Committee was resolved at the 96th Regular Shareholders’ Meeting (held on June 24, 2019) to be within 60 million yen per year. At the conclusion of the general meeting of shareholders, there were four directors that are Audit and Supervisory Committee members.

4.

Individual compensation for directors (excluding directors who are Audit and Supervisory Committee members) is determined by the Board of Directors after consultation with the Nomination and Compensation Council in accordance with the basic compensation policies, compensation structure, and decision-making process for compensation. The Company has determined that this is done in accordance with the basic policy.

5.

The indicator for performance-linked compensation is net profit attributable to shareholders of the parent that is directly linked to the return of profits to shareholders.

Total Amount of Consolidated Compensation for Each Officer

| Total amount of consolidated compensation |

Officer category |

Company category |

Total amount of consolidated compensation by type | ||||||

| Base compensation |

Performance-based compensation |

Restricted stock compensation |

Board Benefit Trust (BBT) |

Non-monetary compensation |

|||||

| Unit | million yen | ‐ | ‐ | million yen | million yen | million yen | million yen | million yen | |

| Name | Hitoshi Yoshida |

185 | Director | Reporting company |

60 | 70 | 3 | 51 | 55 |

| Ryuichi Kimura |

185 | Director | Reporting company |

60 | 70 | 3 | 51 | 55 | |

| Koichi Kawamura |

151 | Director | Reporting company |

51 | 59 | 3 | 37 | 40 | |

Notes 1.

The table above only includes officers whose total amount of consolidated compensation, etc. is 100 million yen or more.

2.

Amounts indicated with figures below one million yen omitted.

Related Party Transactions, Etc.

The Company shall not be engaged in any transactions with Directors and/or major shareholders that may damage the interests of the Company or the common interests of the shareholders, as indicated in “(7) Related Party Transactions” in “2. Directors and Boards” of the Basic Policy on Corporate Governance. When a Director is intending to enter into a transaction with the Company for him/herself or for any third parties, the Director shall obtain prior approval of the Board of Directors according to the rules of the Board of Directors, and report important facts in that transaction at the board meeting. Terms and conditions for the transaction may be determined in the same manner as a transaction with third parties.

To identify any transactions involving a conflict of interest by Directors, the Company checks annually and regularly existence of such transactions (excluding director compensation) between the Company Group and Directors or their family members within the second degree of kinship.

When the Company is intending to enter transactions between the Company and major shareholders or other related parties, then it shall be approved in advance by personnel with authority commensurate with the importance and scale of the transaction in accordance with internal regulations determined by the Board of Directors.

Cross-Shareholdings

The Board of Directors comprehensively examines whether shares held as cross-holdings are worthwhile based on risks and returns from the perspective of medium- to long-term economic rationality and qualitative considerations such as the purpose of holding those shares and the credit status. If this examination results in the judgment that it is not worthwhile to retain the cross-holdings, such holdings are reduced in principle. If it is determined that holding such shares will contribute to the improvement of medium- to long-term corporate value, they are retained. As a result of such deliberation, Tokyo Seimitsu sold 19 cross-shareholdings (including shares deemed to be held) for 8,415 million yen between April 2015 and March 2025.

Environment・Society・Governance